Leaderboard

Popular Content

Showing content with the highest reputation on 02/04/2016 in all areas

-

Just acquired my first high grade bun penny from Pete ( @PWA 1967) ... an 1891 Gouby BP1891AB graded and slabbed CGS 75. As indicated (by Pete and others) it is much better than the CGS pics suggest, so very pleased. I may try and take my own pics through the slab ...3 points

-

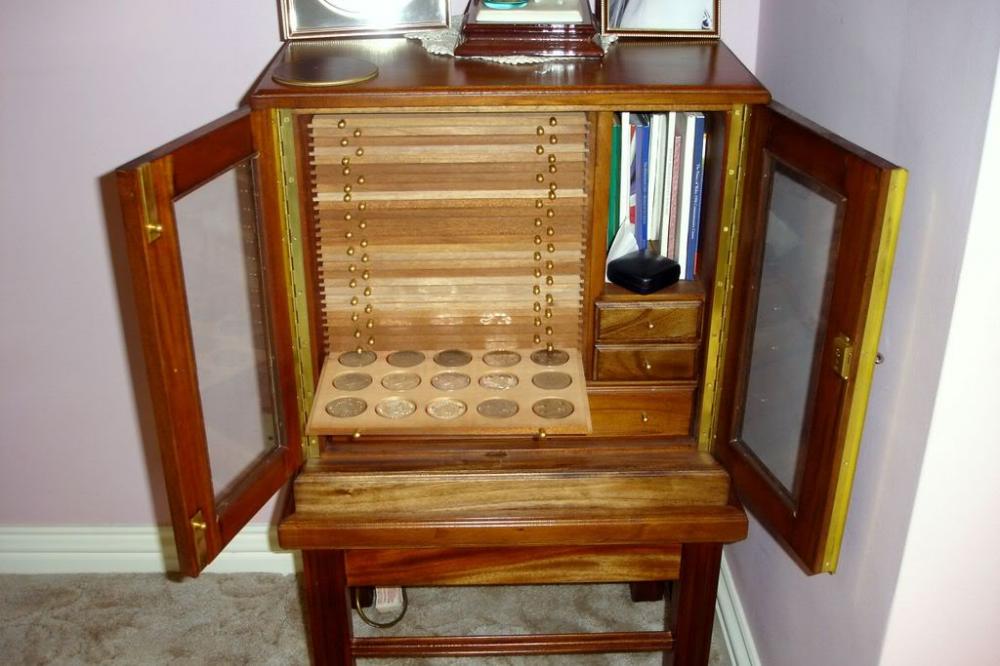

And the internal view. He wanted to put a map of England on the top with the Saxon mints, but this was impractical. http://3 points

-

3 points

-

Just received a few nice pennies from Pete today too, all raw though as that's what I collect. A really nice 1950 proof, 1948 BU and a nice example of the 1946 Dot. Very happy with them. Not that I ever had a doubt. Great coins from a great guy who has been very helpful to me and many others. Thanks Pete, appreciate all the help.2 points

-

1 point

-

1 point

-

Don't forget you can always buy them and crack them out, the CGS ones are especially easy to open up1 point

-

1 point

-

They are all hand made so won't be cheap. And I got the impression Peter used a range of varnishes that weren't good for your health. The current owners of the business use more environmentally friendly processes. I had a tray made for my smaller cabinet recently and thought they did a good job at a reasonable price. Of course second hand cabinets from auction might be a easy of getting one a bit cheaper...1 point

-

Them being no longer made by Peter Nichols may have also inflated the price. I'm sure they were a bargain when he knocked them up himself in his back shed.1 point

-

Having a look at something now and seeing if Chris wants to do it, it's not a quick fix.1 point

-

Just wanted to say hello to a fellow farthing fanatic.....I understand why many people recommend cabinets and they do look very nice, but I have never used one. I have my collection split between albums, and my own slabs. I use the Lighthouse Optima albums with pages that hold coin envelopes/2" x 2" flips Acetone will normally work on removing the green residue if it is PVC, but not a great substance to have sloshing about, and definitely trial it on a few of your less favourable bits to ensure you are happy with the results first1 point

-

Keep investments and hobbies separate. Coins and other illiquid collectibles are second or third tier investments, no more. As they are not immediately tradable, it is difficult to see why people would pay a premium to 'invest' in coins for profit. Anyone who thinks that SG or LC don't take their routine cut of about a third (in line with other auctioneers) is deluded. The market has to be out of control to recoup an immediate loss of a third on investment in the short term. Long term your coins can do very well. 7% or more compound over the past 50 years is a very good return, but you have always had the cost of purchase to consider, which eliminates them as a short term investment. It would be interesting to see what would happen if half a dozen people wanted to realise significant holdings in investment coins at the same time. As the companies marketing investment packages are to all intents individual markets in toto, realising a high price for the sellers requires half a dozen plus one willing buyers to create the competitive market. I can't see it as a viable option in investment terms because the market is a closed one with the middle man making all the turns available and only offering profits as a marketing tool. Avoid.1 point

-

May I add my own thanks too, Prax. I find it fascinating to know some of the history of the great coins that come to market. It just adds to the joy of collecting. I remember the slender 3 going way beyond my budget and I never knew that an Unc open 3 was lurking behind the scenes. There are always more wonderful specimens to emerge and excite us all. Thanks again.1 point

-

Too many people have asked me about the slender 3 and why I exited the market only to re-enter a few years later. Here's my story between 2003 and 2011. Collecting coins was always a hobby of mine. But only in 2003, after moving to Cardiff, did I take it seriously. I used to buy silver and gold coins in bulk from scrap traders and jewelers only to separate the half decent coins and sell the rest on as scrap. This way I began to build a decent collection by only paying slightly over bullion value for coins. Slowly by 2004 I started to buy non bullion coins as well. Within a year I acquired a few very rare pennies, including an UNC 1903 open 3; and became more interested in pennies. In those days the demand for pennies was stratospheric (I am of the opinion that the market for coins is subdued at the mo). On ebay you had people like C Morgan, Tony C, L Bamford, M Platt, C Davies, G Schindler, F Fiona etc who'd snap anything of interest and the selling price for pennies in auction-houses wwas pretty steep too. If you recall in 2003 a decent sovereign was selling for £45 - 60, yet at the same time a cleaned 1875 H specimen penny from the Adams sale was going for about £960 (https://spink.com/lot-description.aspx?id=3011262). I still retain this coin (The same coin will perhaps sell for around £1500 today but a sov is selling for around £200). So I decided to sell my pennies and invest in silver. By 2009 a mate and I had about 300 kgs in silver and we started a refining business in Birmingham producing 990 silver for big names to put their stamp on. By 2012 the metals market nosedived and I exited the business after taking a 30% cut on my investment. However rather than taking my share as cash, I took just over 90 kgs in pre 1920s silver. Again I sold all the 1911-9 coins and damaged coins for scrap and I still retain over 30 kgs of at least clear date pre 1911 silver, which have not been checked for variants. I have stocked this in an bank vault and I intend to use this for my retirement project. Must be fun sorting through each coin using an ESC book, some of which are from the mid 1600s. Since 2013 I have returned to pennies and have started rebuilding. Coming to your other question 19k was pretty good but considering the demand at that time I'd say it wasn't unexpected. I had a cash offer of 13k for the slender 3 and 5k for my 1903 open 3. I gave the coin to LCA on the condition that I would take 13k+ (after commission) or not pay the commission if the coin did not sell. The die number 5 penny, which sold a year prior, went for more than the slender 3. The pattern 1933 sold for over 30k during the same time. The market then was very buoyant. In my opinion (adjusted for inflation) collectibles' prices are low at the moment. Property is on the up (but I believe it might have peaked) and this is precisely why I created a tread called markets in the "everything goes" section1 point

-

1 point